How Much Does A Personal Loan Have An Annual Percentage Rate?

Feb 26, 2024 By Susan Kelly

When applying for a personal loan, the Annual Percentage Rate (APR) is one of the most important things to consider. It shows the interest rate a lender charges on loan over a year, including any fees or charges accompanying the loan. It is an important tool for people who want to borrow money and compare their loan options. The APR is shown as a percentage of the loan amount and includes the interest rate and any other fees or charges that the lender may charge, such as origination fees, prepayment penalties, and application fees. The APR gives a clear picture of the total amount that will be paid back over the life of the loan. This lets borrowers compare borrowing costs from different lenders and loan options. Borrowers should also know that the APR can change based on how much they borrow.

What Is An Annual Percentage Rate?

A lender's interest rate on a loan over a year is called the Annual Percentage Rate (APR). The annual percentage rate (APR) is shown as a percentage of the loan amount. It includes the interest rate and any other fees or charges accompanying the loan. It gives a clear picture of how much it will cost to borrow money and helps people compare their options.

Understanding The Components Of APR

The annual percentage rate (APR) comprises several parts borrowers should know. These parts include the interest rate and any other fees or charges from the loan.

Interest Rate

The interest rate is the amount of money a borrower has to pay on top of the loan amount. It is usually shown as a percentage of the loan amount and can change based on the borrower's credit score, the loan amount, and the time it takes to repay the loan. The interest rate is a key part of the APR because it directly affects how much it costs to borrow.

Additional Fees Or Charges

The APR includes not only the interest rate but also any other fees or charges that go along with the loan. These fees may include origination fees, prepayment penalties, application fees, etc. Depending on the lender and the loan amount, these fees can significantly affect the total cost of getting a loan.

How Does Apr Affect The Cost Of Borrowing Money?

When getting a personal loan, the APR is very important because it can greatly affect the cost of borrowing money. If the APR is high, the borrower will pay more in interest and fees over the life of the loan. If the APR is low, the borrower will pay less in interest and fees over the life of the loan. Let's look at an example to show how APR affects how much it costs to borrow money. Let's say a person takes out a personal loan for $10,000 with a 10% APR and a five-year term. In this case, the interest will cost the borrower $2,594 throughout the loan. If the APR were 15%, the borrower would pay $4,155 in interest over the same five-year period.

Comparing Loan Options

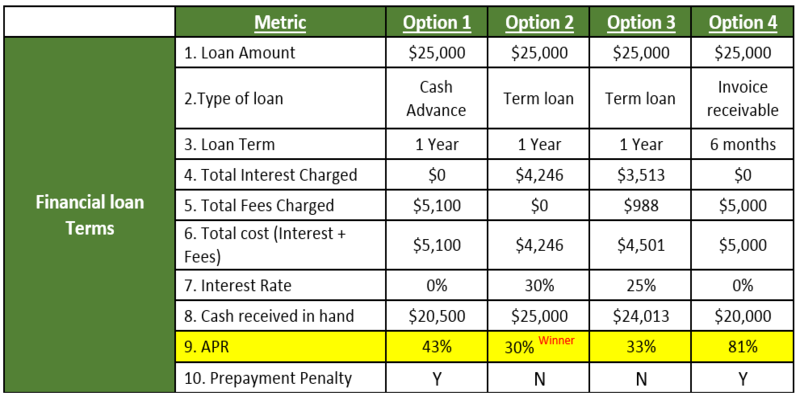

One of the best things about using the APR to compare loans is that it gives a clear picture of how much it will cost to borrow. Borrowers should always compare the APRs of different loan options to determine the most affordable. When comparing loan options, borrowers should also consider the repayment terms, the loan amount, and the lender's reputation. By carefully reading the terms and conditions of each loan option, borrowers can make an informed decision and choose the best loan option for their financial needs.

Conclusion

When applying for a personal loan, the Annual Percentage Rate (APR) is one of the most important things to consider. It shows how much it will cost to borrow over a year, including the interest rate and any other fees or costs that come with the loan. Borrowers can use the APR to compare different loan options and figure out how much they will have to pay back in total over the life of the loan. When considering a personal loan, borrowers should know that the APR can change based on the loan amount, how long it takes to pay back, and how good their credit is. To find the best APR for your finances, it is important to compare different loan options. APRs may be lower for borrowers with higher credit scores and shorter repayment terms, while APRs may be higher for borrowers with lower credit scores and longer repayment terms.

Dec 12, 2023 Triston Martin

May 18, 2024 Susan Kelly

Jan 22, 2024 Triston Martin

Feb 09, 2024 Susan Kelly

Mar 15, 2024 Susan Kelly

Mar 23, 2024 Triston Martin