When Will Stocks Begin To Rise Again? Here's What Experts Think Will Happen

Dec 18, 2023 By Triston Martin

Global events, economic indicators, and corporate performance are just a few variables affecting the stock market. The recent COVID-19 epidemic has caused substantial volatility and concern in the stock market. Consequently, people want to know when will the stock market recover will and what will cause it to rise or fall. This piece will investigate how experts' predictions about the stock market's eventual rebound stack up against reality. We will look at how the COVID-19 epidemic and vaccine distribution affected the stock market and other economic indicators, fiscal and monetary policy, firm performance, and geopolitical concerns. Considering these things, investors may optimize their profits while minimizing risk in an ever-changing and volatile market.

The Rollout Of The Covid-19 Vaccine And Pandemic

The ongoing COVID-19 outbreak has further amplified stock market volatility and uncertainty. In March 2020, when the stock market will recover and crashed when the epidemic started to spread swiftly throughout the world. Since then, the market has shown a very unpredictable tendency, with both rising and falling phases. The speed of the vaccine distribution and nations' capacity to restrict the spread of the virus, experts say, will be crucial to the stock market's recovery. The economy and consumer confidence should grow as more individuals become vaccinated. The stock market, as a result, should rise in value.

Economic Indicators

Investors carefully monitor economic indices like GDP growth, inflation, and employment rates to gauge the state of the economy. These economic metrics have a strong relationship with the stock market's performance. According to experts, the strength of the economic recovery is expected to impact the stock market's revival directly. The stock market is expected to do well if economic indicators keep rising, as they have been recently. But, if economic indications continue to show weakness, the stock market might fall.

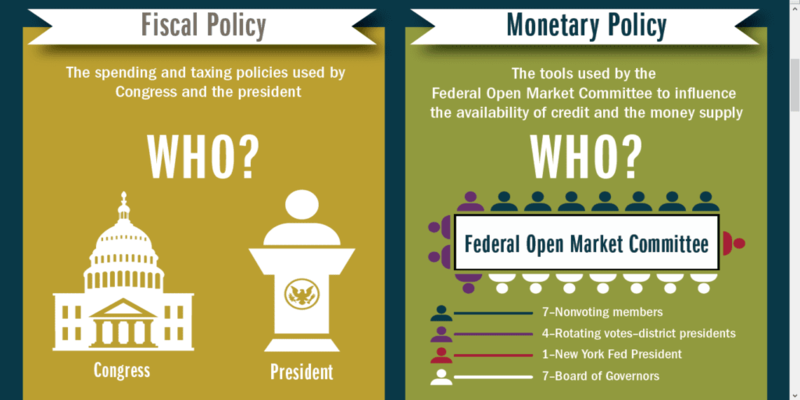

Fiscal And Monetary Policy

There may be considerable effects on the stock market from fiscal and monetary policy changes. Government spending and taxes, two fiscal policy components, may affect economic growth and consumer spending. Borrowing and investment are sensitive to monetary policy decisions like interest rates and money supply. According to experts, government actions targeted at promoting economic development are expected to impact when will the stock market start to recover. Government expenditure on things like infrastructure and stimulus packages is seen to have a positive effect on the economy and consumer spending. Low-interest rates and asset purchases are examples of monetary policy initiatives stimulating lending and investment.

Performance Of The Company

The stock market reacts strongly to news about individual companies. Investor mood and the market's overall performance may be affected by the financial condition of individual firms. The experts believe that certain corporations' actions will determine the stock market's rebound. Successful businesses can adjust to new circumstances and create something new. Businesses with high exposure to the epidemic or too intense market competition may suffer.

Geopolitical Tensions

Global and stock markets are vulnerable to geopolitical tensions and wars between states or political bodies. Trade disagreements, military confrontations, and unstable governments are all potential causes of this kind of conflict. Investors trying to gauge the effect of geopolitical events on global markets and particular enterprises may produce market volatility and confusion. The U.S.-China trade war, U.S.-Iran hostilities, and political instability in Venezuela are just a few recent geopolitical concerns that have influenced the stock market. Investors must keep tabs on global events to make sound financial choices and consider how they can affect the stock market.

Conclusion

In sum, professional forecasts provide useful insights into the elements that will drive the stock market's future performance, despite a great deal of ambiguity and volatility. Investors should consider various circumstances, including the COVID-19 pandemic and vaccine deployment, economic indicators, fiscal and monetary policy, firm performance, and geopolitical concerns while making financial commitments. Even if the stock market's long-term outlook is bright, investors must be on guard and spread their money to minimize loss and maximize gain. The unpredictable stock market may be navigated with educated judgments made by investors who closely watch market trends and professional views.

Feb 07, 2024 Susan Kelly

Nov 10, 2023 Triston Martin

Jan 30, 2024 Susan Kelly

Feb 04, 2024 Susan Kelly

Jan 28, 2024 Triston Martin

May 09, 2024 Susan Kelly