Discuss Briefly: What is Pre-Foreclosure?

Oct 17, 2023 By Susan Kelly

Introduction

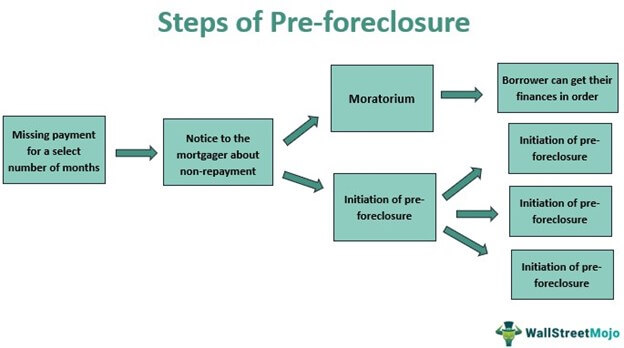

What is pre foreclosure? The term "pre-foreclosure" describes the initial stage of a legal process that may result in the repossession of property from a delinquent borrower. Before a property goes into foreclosure, the lender will record a notice of default if the borrower falls behind on payments over the agreed-upon amount of time. Lenders often start foreclosure proceedings by serving borrowers with notices of default. If a borrower enters pre-foreclosure, they can choose from a few different options. To delay foreclosure, lenders may be amenable to discussions.

To What Extent Do Pre-Foreclosures Differ From Foreclosures?

After gaining court approval, a notice of default can be served, initiating the pre foreclosure process. At this stage, homeowners can work out a plan with their lender to keep their home out of foreclosure by making payments toward their outstanding bills. When a lender has the legal right to evict a late borrower by serving them with a foreclosure eviction notice and selling the property at a public auction, this is known as a foreclosure.

To What Extent Does Pre-Foreclosure Function?

When you fall behind on your mortgage payments, it triggers a series of events known as "pre-foreclosure." By getting a mortgage to fund the purchase of a property, you commit to making regular payments against the principal. If you fail to make your mortgage payments on time and the properties enter the pre-foreclosure stage, you breach your contract with your lender.

Default

Your account will be considered in default after three (3) missed payments. Nonetheless, the cost of foreclosure is substantial for financial institutions. Lenders typically negotiate with homeowners to reduce payments, extend the loan's repayment period, or restructure the loan entirely. Homeowners who have trouble making their mortgage payments may be eligible for foreclosure mediation or other assistance programs.

Default Notice

A notice of default is issued after nonpayment has gone uncured for three to six months. This is a formal notice from the lender indicating they intend to sue you for the outstanding debt. The lender will also publish a statement with the County Recorder's office or file a suit with the court. The pre-foreclosure period might run from three to ten months, and it now officially begins.

Auction

The bank's primary concern is recovering any funds that are rightfully theirs due to them from the property. The trustee may sell your home at auction if you fall behind on your mortgage payments and do nothing to fix the problem. The amount of the loan itself is the starting bid at auction. The highest bidder receives the foreclosed property.

Advice on Purchasing a Pre-foreclosure Home

It is prudent to purchase a property just before it goes into foreclosure. The multiple listing service website is an excellent place to begin your search. There is a chance that the price you pay for a home in this manner will be far lower than the market value. People in the market for a new place to live might save a significant amount of money in this way. Pre-foreclosure home sales are popular since many buyers can resell the properties at or near their original asking prices. When purchasing a home that is in pre-foreclosure, there are a few things to keep in mind:

Collaboration With A Real Estate Agent

When a home is under pre-foreclosure, it usually has several restrictions placed on it by the court. Someone who needs to be more careful could have to deal with legal issues after purchasing such a residence. Before buying a home that is under pre-foreclosure, you should always consult a real estate agent about the process's legality.

It's Also Crucial To Have A Home Appraisal

The worth of a house can be determined by doing an inside and outside inspection. The cost of repairs and updates might be factored into the final valuation. Even though a home is listed as being in pre-foreclosure, it may already be in such bad shape that it is not worth purchasing and repairing.

Contact The Seller And Attempt To Negotiate

The buyer will work directly with the seller when purchasing a home via such a listing. Feel free to try to negotiate with the bank over a pre-foreclosure home. Negotiating can result in surprise discounts, even for first-time homebuyers.

Conclusion

In some cases, the borrower may be able to negotiate with the lender over past-due payments during the pre-foreclosure process. Before a property goes into foreclosure, the borrower usually has one last chance to prevent eviction by paying off past-due charges, renegotiating the loan terms, or selling the property. Distressed pre-foreclosures are potentially lucrative, but first-time investors should take the time to familiarise themselves with the market. Pre-foreclosure home buyers tend to be savvy financiers. To be successful, you need expertise in the field, the ability to negotiate, and ready cash.

Jan 27, 2024 Triston Martin

Feb 03, 2024 Triston Martin

Jan 30, 2024 Susan Kelly

Dec 15, 2023 Susan Kelly

Feb 21, 2024 Triston Martin

Feb 23, 2024 Triston Martin